I remember being just out of college and feeling inundated with advice. “Follow your dreams” but also “have a 5-year plan.” “Save for retirement,” but at the same time, “travel the world now while you’re still young and healthy.”

I felt like I just needed some time and space, and then I’d pay attention to all the “rules” about life and money later. But I didn’t realise that weaving in good financial habits in your twenties doesn’t mean living a strict life or shying away from fun. Rather, these skills can enhance your youthful years, while setting you up for financial success later.

Here’s how to start.

Define your life goals

Write down what you envision in life. What kind of lifestyle do you expect or want to have? Where do you want to live? What kinds of jobs — and salaries — seem both appealing and achievable? Evaluate whether your education, skills, and current activities are in line with those goals. If not, figure out where to make some changes. Interview people who have your dream job and understand how they got there.

Practice networking and reinventing yourself

Join a networking group, sign up for a class, or take part in a society or club tied to issues you care about. Know that there’s never going to be a point when you’ve “made it” and can just coast. Keeping up your social and professional connections is an essential way to stay plugged-in and find support if you want to change careers or find yourself at an impasse.

Learn how to manage your budget independently

The faster you make it on your own, the more you’ll grow to believe in yourself and the stronger your skills will become. Know exactly how much you earn, and what you can afford to spend. One guideline for people in their twenties is the 50/30/20 rule: No more than 50% of your after-tax income on necessities, no more than 30% on wants and at least 20% on savings and debt repayment (such as student loans). Strive to avoid credit card debt. Even if you have parental help, create a plan to become fully independent.

Use a budget tracking app

Stay intimate with your budget by using the device that’s next to you all day long — your phone. There are many apps that can help you set goals, analyse your spending, and help you save. Some people like to import their bank transactions automatically, while others prefer to manually enter information in order to be more conscious of their budgets.

Invest in your retirement

If your job offers a retirement account — and better, matching funds — sign up immediately. Allocate 15% of your income to retirement investing. If that feels too restrictive, you can adjust later. But it’s easier to set up automatic savings at a high rate and reduce it later if you’re struggling, rather than the other way around. If you don’t know what your retirement investing should look like, talk to a tax accountant to learn about tax-advantaged retirement investments.

Create a mini-portfolio

Invest for short-term goals. Open an investment account and set up an automatic transfer from your paycheck. I recommend using robo-advisors, or investing in ETFs and index funds, rather than picking individual stocks. Set goals like saving for a home, a vacation, or even your professional wardrobe.

Sign up for insurance

Everyone needs insurance for life’s mishaps, like job loss, accidents, and natural disasters — it’s just a matter of how much. Make sure you have health insurance, and if you have children that you are financially responsible for, life insurance, and if you have a vehicle, auto insurance. Some places also offer rental insurance for tenants that cover the cost of all your personal belongings, no matter if they’re stolen or burned in a fire.

Be entrepreneurial

Do you happen to be really good at cooking? Tutoring? Flower arrangements? Organising? Think about whether your skills could be marketable. Yes, having a side-gig can be a lot to juggle. But having separate flows of income is essential to financial stability so that one job loss doesn’t ruin you. Having a side-gig, especially in something you’re passionate about and good at, is a great thing to do at an age when you have lots of energy and free time.

Always be learning

Dive into the topic of personal finance. Become curious about how to build wealth. Take a workshop, like the ones offered by my company, Heels & Yield, or find an online course. Go to the personal finance section of your library or bookstore (but be wary of highly specific investing advice or get-rich-quick promises). Know that money is something you have to keep learning about throughout your life.

Invest in yourself

Each moment that you try hard at your job, stand up for yourself or commit to learning something new is like putting money in the bank — the bank of you! Learn what your employer is looking for when they complete a performance review, and strive to meet those expectations. Ask for and receive feedback. Learn how to ascertain how much you’re worth and how to ask for it. This way, getting raises, promotions and new jobs will be integrated into what you’re already doing, rather than a foreign and isolated exercise.

This article is for general guidance and informational purposes only and should not be treated as legal, accounting, financial, investment or tax advice. For specific questions related to your financial, legal or tax situation, please consult a professional advisor.

Editor

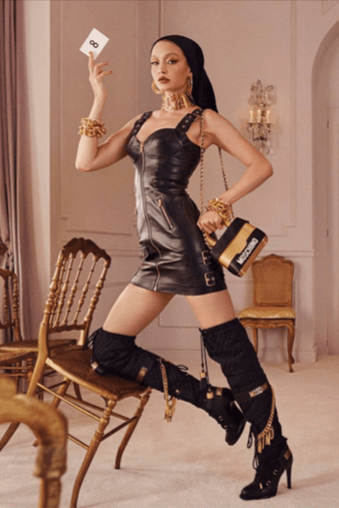

Angelina YaoCredit

Header image: Arthur Elgort/Conde Nast via Getty Images