Wealth has traditionally always been defined by numbers. Yet, when we take the time to consider what’s truly worthwhile in our lives, it becomes clear that the things that matter go beyond mere material possessions or social status. For the modern woman, wealth is having the freedom to escape the constant struggle and competition of life in order to devote herself to pursuits that fulfil her soul—whether that is making a difference in her community or honing a creative skill.

The views we have surrounding wealth are changing—and it is women, in particular, that are spearheading the conversation. With a vast scope of expertise in financial and wealth management, HSBC has made it its mission to support and empower women at every stage of the journey, as they navigate opportunities and build financial confidence. For some women, that could mean taking their first steps towards investing. For others, it could be planning to pass their wealth down to the next generation.

To explore all the ways in which the perspectives on wealth have shifted, especially for women in an Asian society, Vogue speaks to two purpose-driven female entrepreneurs. Both featured on HSBC-sponsored international financial podcast, Girls That Invest, they open up on how their personal financial journeys have progressed over the years and share their best advice for women looking to achieve financial freedom and build wealth.

Rachel Lim, co-founder of Love, Bonito

As the co-founder of local fashion label Love, Bonito, Rachel Lim believes in inspiring and empowering women to come into their own. Having built an uplifting community for women that goes beyond fashion, she has successfully expanded her business internationally—with a physical store in the US slated for 2023.

As a woman living in an Asian society, how do you personally define wealth?

As I grow older in life, I’ve realised that, first and foremost, health is really wealth. Having experienced a few health scares over the last couple of years, I’ve learnt that unless I take care of myself and my health, I can’t take care of those around me. In an Asian society, the notion of family is also very important—and of course, family can be defined however we choose. So for me, I view wealth in terms of my health and my relationships.

What does financial freedom look like to you?

This is something I heard from the Girls that Invest podcast and found extremely relatable: financial freedom is the liberty to be able to say yes or no to whatever life throws at you.

Do you think women’s attitudes towards wealth have evolved over time?

Yes. From my personal experience, in our grandmothers’—or even our mothers’—generation, there were many instances of women having to rely completely on their partners for financial support, and that can sometimes prevent them from making the best decisions for themselves. That narrative is shifting today. There is now a lot more discussion about gender equality or marriage equality, and it’s very encouraging to see how women are much more confident and empowered financially. That plays a huge part in what a woman can do for herself, her family and her loved ones. Whether a woman chooses to start a business or to be a stay-at-home mum, she has the ability to make her choice independently.

It may be daunting for many to start learning about financial planning. How did you personally start your own financial journey?

For me, it started with unlearning the false narrative that investing is only for when you’ve accumulated a cushy sum of money, or after you’ve hit a certain age. Growing up, especially in Asian culture, it was always instilled in me that it’s important to just save whatever money you have—but now I know that as time goes by, the value of my savings shrink because of inflation and such. Learning that in my late 20s was very new to me, and I’m grateful that I had people around me who sparked that conversation. I used to be very intimidated when people asked how I was investing, but I think the key is that you can start small. You can start wherever you are, with whatever money you have.

Do you think running a business has given you more confidence about your ability to manage your own financial journey?

People tend to be under the impression that if you’re an entrepreneur, you’re also really savvy with money, but that’s not the case for me. Maybe I’m the odd one out. Whether in business or in my personal life, I recognise that I struggle a lot with the financial aspect of things. That’s why I intentionally surround myself with people who have much more expertise on the subject so I can learn from them, especially at work. In that sense, being an entrepreneur has opened my eyes to the importance of managing my finances, and has also allowed me to reach out to others in order to improve myself in that aspect.

Love, Bonito has built up a really empowering community for women across the globe. Was that something you always aimed for, and how does it tie back to your personal definition of wealth?

I believe that Love, Bonito isn’t just in the business of fashion. Fashion is just a vehicle for us to reach out to women, and in the next decade, we’re excited to see how we can expand our ecosystem beyond fashion. The goal has always been to build communities for women all over the world to come together, empower one another and live their best lives. Ultimately, we want to journey together with women as they come into their own. That aim is rooted in the importance of building relationships with one another and taking care of our own mental, emotional and physical health—which relates back to my own perception of wealth.

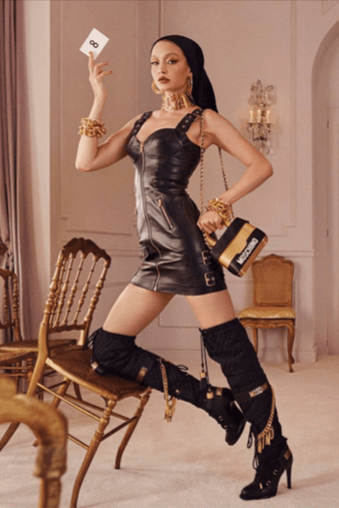

Olivia Cotes-James, founder of Luüna

Olivia Cotes-James founded Luüna, a women-led menstrual health brand built on the basis of sustainability, accessibility and inclusivity. In addition to creating eco-friendly period and symptom care products, the brand takes menstrual health a step further, offering programs and services aimed at transforming the menstrual health experience within businesses, schools and universities.

What does wealth personally mean to you?

Wealth is about having the ability to spend in a way that reflects my personal values. And that goes beyond just the number in your bank account. Wealth is reflective of a certain type of mindset as well, whereby you are in the position and have the mental capacity to even be able to consider what purchases reflect your personal values.

Has your perspective of wealth changed since you started your business?

It’s changed so much. Growing up, my understanding of personal wealth was quite rudimentary, and I didn’t know much about business or entrepreneurship either. I call myself an accidental entrepreneur, because I never set out to start my own business. I just discovered a problem I was extremely passionate about fixing, and it’s brought me here today. But my role with Luüna has showed me how important it is to really understand how processes work. That’s really crucial when it comes to managing your wealth, understanding what you’re investing in and being aware of the details of financial planning. Starting Luüna has definitely pushed me to be more in control of my financial decisions and undertakings.

Have you noticed how conversations about wealth have been shifting, particularly as a woman living in Asia?

There’s been so much more research and so many more case studies done around women and women’s wealth in Asia, and that definitely translates to more open and honest conversations about what our needs actually are when it comes to effectively and productively managing our money. In the last few years especially, conversations have evolved so quickly, and that’s been brilliant to see. There’s still progress to be made, of course. With any conversation involving gender, we need to make sure we’re not putting the onus on just one group to make all the decisions. As we open up discussions about women accumulating wealth, we also need to make sure that we’re educating other individuals—in this case, men—to be able to make those conscious investment decisions too.

Do you think choice and convenience have a big part to play in financial literacy today?

For me, the keyword in this question is choice. I think women haven’t always been given choices, which is the case when it comes to financial planning. We’re not the only group who have been neglected, by any means, but I believe we should be striving towards a world where every woman is as informed as her male counterparts when it comes to financial literacy.

Is there any advice that you can share in terms of financial planning?

Personally, I have a three-year plan. This year and the next is all about learning, and I’m doing that through conversations with people who are more knowledgeable about the subject than me. I’m investing my time in that with the aim of being able to achieve one of my personal goals in the next three years, which is to make an investment in an early stage start-up that I believe in and that I can contribute my knowledge, advice and financial capital to.

Something I personally believe in very strongly is that whatever platform or avenue you use, you should take the time to dive deep into the values those tools are rooted in. I’ve seen now how people achieve wild levels of success from very different starting points, and it’s always those who stay grounded in their values that I admire the most. Ultimately, they are the ones who are able to accumulate financial success, and at the same time, attain the level of fulfilment and mental wellbeing that is so crucial to leading a happy and contented life.

Photography Sayher Heffernan

Creative producer Vanessa Caitlin

Styling Gordon Ng

Hair and make-up Nicole Ang | Suburbs Studio

Associate creative producer Hazirah Rahim

Digi tech JC | Stills Network

Production assistant Leonard Wong

HSBC can connect you to global opportunities at every stage of your wealth journey. Find out more at internationalservices.hsbc.com.

Editor

VOGUE Hong KongCredit

Lead image: Sayher Heffernan