After months of industry speculation, Amazon is finally launching its Luxury Stores experience. Oscar de la Renta is the first and only label to open a shop-in-shop today, though more established and emerging ready-to-wear, accessories, and beauty brands are expected to join the new platform in the weeks to come. Christine Beauchamp, president of Amazon Fashion, tells Vogue, “We’re excited about creating an elevated and inspiring customer experience, while also infusing innovative technology to make shopping easier and more delightful.”

Luxury Stores is launching on Amazon’s mobile app, and eligible U.S. Prime members will receive an invitation to experience the service via email. Anybody who doesn’t have an invite from Amazon in their inbox this morning can register for one through the new website. Beauchamp explains the strategy: “Mobile shopping is incredibly important for our customers. We find that the Amazon fashion customer overwhelmingly shops fashion in the mobile experience, so we began it with mobile, where our customer begins. In fact, in the past year [Amazon] customers have ordered over a billion fashion items on mobile.”

That’s a very attractive number, as Oscar de la Renta CEO Alex Bolen makes clear: “I would guess that somewhere near 100% of our existing customers are on Amazon and a huge percentage of those are Prime members,” he says. “So they’re already in that environment. For me to get more mindshare with existing customers in addition to getting new customers—that’s the name of the game. We want to be able to talk to her wherever she’s comfortable shopping.” When pressed about luxury’s perceived resistance to the world’s largest online retailer, he adds: “This idea that you don’t want to speak to a customer where she’s spending a lot of her time is a mistake.”

For the record, Amazon has over 150 million Prime members, but the company is banking on more than just its prodigious size. It’s operating Luxury Stores as a concessions-based platform and giving brands more power and freedom than they tend to enjoy in a traditional department-store relationship or on one of the premier luxury e-commerce sites. Bolen and his Oscar de la Renta team are able to independently make decisions regarding their assortment, their pricing, what they will showcase to customers when, what kind of customer service they’ll offer (there are no customer reviews on Luxury Shops), and whether they will utilize fulfillment by Amazon or do their own shipping. “Fundamentally our relationship with Amazon is not a wholesale arrangement,” Bolen says. On launch day, the brand’s pre-fall and fall 2020 collections will be available.

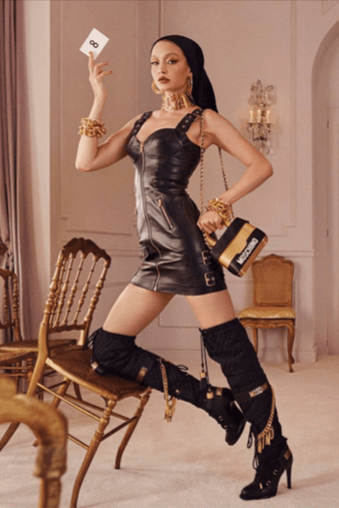

“We really believe this is an opportunity to partner with luxury brands who are seeking tools and a synergistic environment to bring luxury shopping into the future,” Beauchamp says. (Earlier this year, Amazon partnered with Vogue on the Common Threads initiative, which was formed to lift designers’ sales during the pandemic. Anna Sui, 3.1 Phillip Lim, Victor Glemaud, Adam Lippes, and Deveaux were among the participating brands.) Luxury Shops was built on customer feedback. “Our customers share with us that when they’re shopping for luxury that they’d like it to be an immersive, inspiring experience. Increasingly they’re looking to understand not only the product itself but the story of the brand, the craftsmanship, the make.” Amazon and Oscar de la Renta collaborated on a launch video, starring Cara Delevingne, directed by Bunny Kinney, and styled by Jason Bolden.

Aligning content with commerce is a winning formula, but engaging videos aside, Amazon’s most impressive innovation is its View in 360 tool, which is an interactive 360-degree-view feature that allows customers to visualize how select garments will look on various body types and skin tones, with multiple models for each dress size. It was designed, Beauchamp explains, “to overcome any shopping challenges pertaining to size, fit, draping, and whether the garment will be flattering.”

Bolen explains the challenges of online shopping for a ready-to-wear brand. “For us,” he says, “one of the huge frustrations of digital is return rate. The return rate in our brick-and-mortar stores is low single digits on a bad day. Online, it’s almost 30%. If digital becomes an increasing part of our business, and the smart guys say it could reach 30%, 40%, that has huge implications. It means I need to have much more inventory, many more people dealing with returns. It’s kind of a different business than what we’re used to. We have to learn on the fit side how we can get better, and Amazon is very interested in that problem. They’ve got teams of people that are thinking about this all day long.”

Amazon won’t reveal its upcoming brand partners, but there’s no way it doesn’t disrupt the way luxury fashion is purchased. Luxury Stores arrives in a moment when the designer and retailer relationship is being problematized. In May of this year, Dries Van Noten, one of the industry’s most beloved and respected designers, spearheaded an open letter advocating for selling clothes in the season they are intended for—coats in winter, swimsuits in summer—with the discounting periods limited to the end of the seasons. By the end of June, there were 80% off sales on some e-tail sites. And the pandemic is likely to make retailers’ terms more taxing. Meanwhile, launching and maintaining direct-to-consumer e-commerce could be cost prohibitive and complicated for the emerging brands that Amazon says are part of its future. The store’s store-within-a-store strategy presents a seamless solution. And let’s face it, size matters. Says Oscar de la Renta’s Bolen: “In general, learnings are something with Amazon that we can’t get to the same scale with other people. We think we know things about our customers, but do we have it on the scale that Amazon is going to be able to gather it? We don’t.”

Previously published on US Vogue

Editor

Nicole Phelps