What sold in 2020 depicts our changing world amid a year like no other. (I know: Talk about understatement; like no other barely describes what we’ve been through.) It was a year in which we found creative expression in at-home dressing that was casual, comfortable, and sometimes even cool. (Quite literally: Clothes in a pale neutral and understated palette—from The Row, Jil Sander, Ganni, Totême, et al.—sold and sold and sold.) To go with all that were shoes that promised the outside world but were more likely to be walking across stripped floors: loafers, sneakers, and the big hits, flat sandals or Birkenstocks

All the time indoors let us really consider the kind of purchases we wanted to make, and just like that, fine jewellery, from a major player or a newbie artisan, resonated in a way like it’s never done before for more people than ever before. Ditto the swift uptick in the purchasing of blue-chip classic bags from Chanel, Hermès, or Louis Vuitton, with a strong showing (again) from Bottega Veneta (all hail the Jodie, because almost everyone else did), Christian Dior (the Saddle bag, the Book tote), and Balenciaga’s Hourglass. We’re buying them with an eye to keeping them forever or selling them on: The circular economy is now in full spin. Meanwhile, the micro-bag trend didn’t disappear, powered again by Jacquemus’s teeny-tiny purses.

Something else that’s been impacted by all that time we spent reflecting on the world: how we wanted our values reflected through our clothes. Support of smaller labels with identity and purpose resonated. Sustainability was unsurprisingly top of the list and powered a designer like Gabriela Hearst to be a standout not only among major e-tailers but also the resale world: The day of the announcement of Hearst’s hiring at Chloé, The RealReal reported searches for her pieces spiked 200%, while those looking for her Nina bag went up 208%. The RealReal isn’t the only new retailer we spoke to this year. If we’re really going to capture what sold in 2020, we had to cast the net wider. Even if our world narrowed, retailing expanded like never before.

Natalie Kingham, Buying Director, MatchesFashion.com

Vogue: Which pieces were your customers particularly responding to in 2020?

Natalie Kingham: In general, fashion in 2020 is what makes us feel better, instead of dressing for approval from other people. In terms of categories, it was definitely denim and loungewear, which includes pajamas, robes, leggings, and Birkenstocks. And the real big growth areas were fine jewelry and homewares. It’s not really surprising. We all realized we didn’t have enough things at home to make us feel nice. I had some satin PJs but not enough of them; some robes but not enough of them; some sweatshirts but not enough of them. [As for homeware,] we’ve been spoiled by the tabletops and cutlery at nice restaurants when we were going out to eat.

The craving for fine jewelry during lockdown…Sarah Harris [of British Vogue] said to me yesterday that a ring has become more important because when you look down, you smile—or you had something on your wrist or even your ankle, with an anklet. Fine jewelry at $1,500 has replaced the dress at $1,500.

As we get to the end of the year, we’re seeing people being in two minds more; clothes that are dressy and fun, those emotional purchases, are doing well. It’s almost like that high-low L.A. way of thinking: casual with flip-flops, and then you get really dressed up. We’re all in puffers and sneakers, and the minute any of us are getting to put away those clothes and get into a dress, we are. We will party at home. I am a great believer in dancing in the kitchen with friends—or by myself!

Which designers/brands/labels performed well for you?

Interestingly, it was Jil Sander, Gabriela Hearst, The Row, and I guess that all makes sense, doesn’t it? They offer timeless, versatile pieces that are lovely to wear at home and will also be good investments when we come out of our homes. Also, Totême and Ganni offered something similar at a different price point. It’s the beginning of a new era: the neutral palette that’s been so popular. It’s a palette cleanser. It reminds me of Helmut Lang and Rifat Ozbek at the very beginning of the ’90s; they made the ’80s seem all wrong. We are heading for a reset. I’m calling it a start-over with wardrobe foundations. A simplicity—maybe that’s what it is. It feels right. It’s no different from yearning for fresh air, the countryside, the seaside, being out of cities.

Which newer names took off for you?

Stefan Cooke did incredibly well: the bags, and the womenswear comes in, and it flies out; the knitwear, with all the slices in it. Grace Wales Bonner’s Adidas capsule: In 48 hours, it was all gone. Charles Jeffrey Loverboy has done really well. Chopova Lowena. Art School. We’ve been mentoring them, and they’ve benefited from a lot of time with me and the buying team, as well as a dedicated space on our site.

What did you find didn’t connect this year?

High heels were a struggle. But I think they will come back. I am desperate—and I don’t even wear them! I can’t wait to put on platforms; they will return with a vengeance.

What’s your prediction for 2021?

Dressed-up things with a bit more ease. I miss tailoring, I miss blazers, but they’re going to come in softer fabrics—we don’t all want to wear a sloppy cardigan. Things will be more of a hybrid. If we enjoy fashion, these things will resonate quite well. And as soon as we are all out of this, it’s going to be like the Roaring Twenties!

Brigitte Chartrand, Vice President of Womenswear Buying, Ssense

Vogue: Which pieces were your customers particularly responding to in 2020?

Brigitte Chartrand: Accessories had massive growth. Jewellery has done really well because so many of us were at home and in front of a screen. The bucket-hat trend has not stopped; it could be found from so many brands and was being driven by Instagram. It’s one of the accessories of the year. Of course, loungewear performed really well; that more casual yet elevated luxury product has always been part of our natural aesthetic and point of view. But I was really happy to see that we had great success too with lingerie and swim—personally I am biased with the latter because I am such a beach girl! We had our best year yet with those. Flat sandals are really a thing right now. And rubber footwear, like Gucci’s mules. Loafers and slippers had a very strong year. But really, the huge increase has been in flat sandals.

Which designers/brands/labels performed well for you?

Definitely Maison Margiela. It’s very popular on Ssense. Bottega Veneta; the mini Jodie bag has given us great results. Lemaire is doing very well. Max Mara is doing really well; the teddy coats are really loved by our audience. Balenciaga, particularly the Hourglass bag. Bags, generally, are maybe not the strongest category right now, but Balenciaga is having a real moment. And we launched Marc Jacobs on the site to a great reaction.

Which newer names took off for you?

Tekla from Copenhagen, which we had bought before the pandemic and which delivered during it. The bathrobes and the sleepwear have done really well for us. Also, which is kind of crazy, our Jacquemus at-home capsule that we had arranged with Simon [Porte Jacquemus] several months before the pandemic; that did so well for us too.

Pre-pandemic, we’d had a goal to increase our dresses offer. We couldn’t find elevated, cool daywear dresses. In the end, we’ve had our best year with that category, with capsules from Charlotte Knowles. That’s been a real audience favorite; she’s very talented and great to worth with. Louisa Ballou’s dress and swim capsule did well, as did Nensi Dojaka; Bella Hadid wore Nensi very recently, and now it’s completely sold out. Rui, a Chinese designer based in New York. We also have great success with jewelry designer Justine Clenquet.

We launched homewares and self-care this year: Laetitia Jacquetton’s vessels and beautiful candles from Olga-Goose. It was the perfect timing. They answer the needs of our wide audience and with a strong point of view. We felt that shopping has become even more of a one-stop destination and that there was potential there, given our approach to curation.

What did you find didn’t connect this year?

Handbags. The sales have been bit softer there, though there are always some good sellers. And the other is, for sure, tailoring. We had a big boom with it the last two years, but we’re seeing a decrease in it, a very soft decrease. Anything rigid doesn’t feel that appealing at the moment. It’s much more about fluidity and softness.

What’s your prediction for 2021?

Personally, I am really into way more funky things. For 2021, I am thinking flower power, psychedelia, a sense of extravagance but with a casual angle. We will for sure continue to sell minimalistic designs, but I think there will be a shift towards something personal, less tonally neutral, and uplifting. Flares, plaids, flowers: a call for hope and peace and love!

Sasha Skoda, Head of Women’s, The RealReal

Vogue: Which pieces were your customers particularly responding to in 2020?

Sasha Skoda: Our biggest takeaway about the year was the shift to what we call investment pieces, selling at above $1,000. Handbags and fine jewelry really took off and continue to do so. The sales of Louis Vuitton, Bottega Veneta, and Hermès skyrocketed; their resale prices have increased by hundreds of dollars. For Birkins and Kellys the increase has been tremendous. With Vuitton, it’s all about the classic monogram bags and the mini pochette bags; all of those have increased. We’re seeing similar patterns with jewelry, particularly the obviously branded pieces from Bulgari, Cartier, and Tiffany but also unbranded—diamond tennis bracelets, diamond stud earrings.

Obviously, there has been an increase in loungewear, but beyond that we saw that our data points to the building of a capsule wardrobe using foundational pieces. That’s reflected in women’s coats at about $500; same with women’s knits. Loafers and sneakers are the footwear of choice, investing in those at a higher value. It’s about creating a capsule of timeless pieces, not things that you’ll only wear once or twice. It will be interesting to see what Gabriela Hearst does at Chloé because she really epitomizes that way of dressing.

Which designers/brands/labels performed well for you?

Bottega Veneta, Loewe, Dior, and Versace. With the latter two, there has been a real gravitation toward that vintage era of excess. And the relaunched Dior Saddle bag is still riding high. Gabriela Hearst is a really strong brand for us, with her emphasis on sustainable fashion. Jacquemus has been on top for some time, particularly his mini bags.

Which newer names took off for you?

Ganni. Nanushka, with the leather tops and skirts. By Far for bags and shoes. For some of our customers, it’s their equivalent of investment dressing; a minimal, timeless aesthetic. What’s been interesting about the more emerging brands is the concept of artisanal craft: upcycling, quilting, etc. Collina Strada has really taken off for us.

What did you find didn’t connect this year?

Time will tell when we get back to more everyday life as we’ve known it, but some of the contemporary brands, perhaps with more trend-focused dresses, skirts, etc., aren’t connecting so much. If that’s where our customers have been shopping, they’re now really thinking about where they’re putting their dollars, looking for a quieter, timeless style. But what will happen when we all go back into the office—will there be a 180? It’s really hard to predict.

What’s your prediction for 2021?

Sustainability, first and foremost. Again, looking forward to what Gabriela Hearst will do at Chloé, but in general the luxury brands changing their ideas about production and sustainability is going to be big. The move to craft and the handmade; I am interested to see how that will play out. Someone like Emily Bode was onto that very early on. I’m intrigued to see what will happen in that space.

And of course, we talk a lot about the idea of quiet luxury, but for us Gucci is still at the top, and they’re the very opposite of that. There’s going to be room for both to coexist and with an accompanying acceleration of their resale values. We’re going to see people less concerned about wearing the current season and more about wearing brands led by creative directors that speak to your personal style and values.

Libby Page, Senior Fashion Market Editor, Net-a-Porter

Vogue: Which pieces were your customers particularly responding to in 2020?

Libby Page: With day-to-day life shifting immensely this year and physical events ceasing to exist, we saw a more relaxed approach to dressing. As our customers spent more time at home, comfortability was key, and so interest rose across loungewear from brands such as Lauren Manoogian, Frankie Shop, Lou Lou Studio, Les Tiens, and Suzie Kondi, as well as flat shoes from Manolo Blahnik, Loewe, Khaite, and The Row.

We saw an increase in popularity from our established and luxury brands, most notably in handbags. There was a need for heritage-bag families, such as Saint Laurent and Gucci, who experienced increased interest as customers invested in their forever bags. Our customers want classics that will stand the test of time and showcase quality and craftsmanship.

Tying in with investment pieces, our fine-jewelry department has seen incredible success this year. Audemars Piguet has been one of our best performing high-price-point brands. Even over lockdown, the brand was resonating, and we sold the Royal Oak Automatic Chronograph 38mm 18-karat pink-gold watch, which retails at $56,400.

We’ve seen much more interest in conscious consumerism during 2020 as our customers want to ensure that their purchases align with their values. Our Net Sustain edit and charitable initiatives were very popular during the last year and will continue to be prioritized initiatives for us. We were pleased with the reaction to our Space for Giants exclusive capsule collections, with 100% of the profits going to the international conservation charity Space for Giants. The Ole Lynggaard jewelry was a highlight.

Which designers/brands/labels performed well for you?

Luxury brands saw strong performance, specifically Bottega Veneta, Saint Laurent, and Gucci. As we noted above, there is a shift in focus as our customer is prioritizing pieces with longevity that they can wear forever. Also: Wardrobing brands that have honed their craft in creating everyday basics with a fashion-forward point of view. Brands such as Nili Lotan, Totême, Khaite, Tove, and Gabriela Hearst really mastered this. They brought us knitwear with iconic and instantly recognizable pieces, such as Tove’s Ceres dress, Khaite’s sweetheart ribbed sweater, Totême’s quilted coat.

We experienced double-digit growth for both Totême and Gabriela Hearst and saw popularity within Gabriela’s colorful styles in sustainable fabrics, highlighting consumer interest in sustainability. Totême is a key brand for a capsule wardrobe, providing elevated essentials for customers purchasing products that make their wardrobe work harder. Their leggings, outerwear, and denim have performed very well, with a lot of pieces selling out.

Which newer names took off for you?

With wellness being an underlying theme for 2020, we have seen a lot of interest for meaningful jewelry. Jia Jia provides the perfect assortment of cleansing crystals and stones, serving as “a vessel of energy for the beholder.” Other jewelry brands that performed well included Lauren Rubinski and Eéra, which brought fine jewelry with a point of view. Additionally, Brent Neale, who had that feel-good attitude about it. Customers are looking for investment pieces that can bring them calmness and joy.

New brands Suzie Kondi and Les Tien performed very well upon launch earlier this year. The nature of the product from both of these brands was very apt for the current climate. Les Tiens sold quadruple units upon launch, and Suzie Kondi sold out a few weeks after launch. As our customers spent more time at home, elevated loungewear in an assortment of colors and fabrications became essential in their wardrobe.

What, for you, was the biggest shift in fashion in 2020, in terms of what connected?

We have seen popularity for contemporary brands rise in previous years, but 2020 saw a shift in focus to our established luxury brands. Investment pieces came in the form of well-known designers and styles, as well as higher price points. These investments moved away from the one-time-wear, trend-driven pieces we have seen success with over previous seasons. The popularity of statement pieces that were an easy like on social media has shifted to pieces that are quality driven and have longevity: the perfect pieces to buy now and wear forever.

The concept of buy now, wear forever and a focus on investment pieces has been a key strategy for our buying team and has been the catalyst for a surge of new brands within the fine-jewelry department, specifically Jessica McCormack, Irene Neuwirth, Brent Neale, and Viltier, where we have seen incredible success in 2020.

What did you find didn’t connect this year?

I personally would say one-wear wonders because today I am prioritizing items that are forever buys—timeless and practical, while being beautiful, of course!

What’s your prediction for 2021?

Joyful dressing! Fortunately, we saw a lot of clothing that sparked joy within the spring 2021 collections, which was very much needed. We are anticipating an influx of dressing up in 2021, as our customers shed their loungewear. Whether it will be exuberant shapes from the likes of Christopher John Rogers or bright shades from brands such as Molly Goddard, Proenza Schouler, and Tove, we are looking forward to clothes that will bring a smile to our face.

Escapism in all forms was also a huge trend for spring 2021, across all categories. I think we can agree that the lack of travel this year has taken its toll, so we are hoping for a surge in vacation dressing once our customers are able to flock to warm destinations again! We saw wonderful vacation-ready pieces at Loewe (basket bags), Gabriela Hearst (tie-dye), the new brand Kenneth Ize, and Versace, whose product took on a literal under-the-sea theme.

Sophie Hill, Founder and CEO, Threads Styling

Vogue: Which pieces were your customers particularly responding to in 2020?

Sophie Hill: I think there were two different elements. One we expected, and one we were surprised by and then understood. There has been a huge pivot to athleisure. The lockdown came, and everyone was really focused on what they were wearing at home and their interiors. And the second area we saw was a rise of first-time purchases in high value; that was a response to things being closed, so people were buying pieces that they would have tried on in-store.

So, people were at home, and they had time to really think about considered purchases. As well as those two trends, we saw a lot of fine jewelry and watch selling. The fine wasn’t occasion jewelry, but everyday jewelry pieces that can be worn at home or with existing jewelry. And we saw a rise in custom pieces being ordered.

Which designers/brands/labels performed well for you?

Luxury everyday pieces from Loro Piana and Brunello Cucinelli. Athleisure/loungewear from Cotton Citizen, Les Tiens, La Detresse. Relaxed day dresses from Vita Kin, Asceno, Sleeper . Everyday jewelry from Shay, Anita Ko, and Tiffany—and high-value jewelry from Lorraine Schwartz, Bulgari, and Melissa Kaye, such as her neon collection.

Sneakers and sandals as house shoes: Yeezy sneakers, Dior sandals. Boots, the key brands being Prada and Bottega Veneta. And Bottega bags: the pouches, cassette bags, and now belt bags; they were an easy buy and on-trend.

Other highlights were: Amina Muaddi—fun, playful shoes, update on classic styles, clients love the color. Eéra: bold, colorful take on fine jewelry; Fendi: the logo styles are most popular. And, puffers: Prada and Miu Miu have been key brands; the most comfortable coat to wear this winter.

Which newer names took off for you?

Kamyen Jewelry: incredible one-of-a-kind styles, as well as layering rings and necklaces. Mach&Mach: the update on tailoring, partywear, and the shoes! V by VAK. Anastasia Kessaris: beautiful carved diamonds. And, La Detresse: the new loungewear—acid-wash tie-dye tracksuits. The latter are gender neutral and feel right for the times. A lot of values that really underpinned people going to take time to think about what they’ve been buying, especially with contemporary and sustainable brands. I think that that movement will continue and that values will only become increasingly important. This year has been about becoming much more conscious about everything—including what we are purchasing.

What, for you, was the biggest shift in fashion in 2020, in terms of what connected?

Definitely for 2020 it’s about the circumstances of where we are and where women are taking hold of that casual, gender-neutral dressing. Taking control is not all about heels. I think we will see more brands as gender neutral. People have been much less easily categorized as a style tribe; one day we might be in athleisure, one day much smarter.

What’s your prediction for 2021?

We saw the evening dress fall off a cliff this year, but people are going to want to dress up and go out when they can. There’s hopefully going to be moments of fun.

Olivia Kim, Vice President of Creative Projects and Home, and Marie Ivanoff-Smith, Women’s Fashion Director, Nordstrom

Vogue: Which pieces were your customers particularly responding to in 2020?

Olivia Kim: Retail has always been a form of entertainment, and I believe that rings truer today. Because of the pandemic and the inability to physically discover, never have more eyes been focused on e-commerce. On one end of the spectrum are customers looking for cozy, comfortable basics, and on the other end of the spectrum are customers who are shopping in Space (our boutique for advanced and emerging designers). Customers continue to vie for special, standout, silly, fun, and entertaining fashion. We’ve seen that new and emerging brands are resonating.

Marie Ivanoff-Smith: The acceleration of casualization is an obvious one. It gave way to a new level of comfort and ease, which will be hard to let go when we will be ready to go out and about. The two-piece set (sweatshirt and jogger) continues to be a best seller. In terms of accessories, it was the obvious rush to offer masks that are both fashion and function.

As the country began settling into life at home, dressing for work calls drove the demand for statement earrings, earring stacks that go up the ear, and statement chains—above-the-keyboard style. Our handbag business morphed into silhouettes that allowed for a hands-free experience—crossbodies and slings are always relevant, but these styles intensified.

[And] in footwear, comfort has been the dominant factor at play in terms of easy-on-off silhouettes. Also, lug boots and Chelsea boots have been particularly strong, allowing customers to look good going out or functioning as a fall-weather boot.

Which designers/brands/labels performed well for you?

Kim: Interestingly enough, super-buzzy, Instagrammable brands never missed a beat and if anything gained more momentum during this time. It must be the mentality of “I am bored and stuck at home, so what can I show up on my social channel that makes me and my friends/followers happy?” That definitely includes Marine Serre moon-print anything, Jacquemus Chiquito and Petit Chiquito bags, Molly Goddard colorful Fair Isle sweaters, and Vaquera teddy-bear necklaces.

Which newer names took off for you?

Kim: Peter Do and Merryl Rogge were both new collections we launched and have seen a great response. Both of these designers have come through incredible mentors (Phoebe Philo and Dries Van Noten), so there is a definite cheering squad for them, rightfully so.

What’s your prediction for 2021?

Kim: As a retailer, in particular here at Nordstrom, I’ve always loved that we can be a platform for discovery and share our point of view around relevance with our customers; that matters now more than ever. Customers want to know that we are engaged with issues that matter to them and support brands with messages that resonate with their core values. In 2021, I think customers will continue shopping with this mindset and look to brands that stand for diversity and inclusion, as well as small and emerging brands that have been most impacted by the pandemic.

Ivanoff-Smith: When predicting 2021 trends, we foresee the recent confinement impacting fashion for many years to come. We are ready to experience the joy of dressing again through vibrant multicolored prints applied to gorgeous tops and day dresses, creating a sense of escapism. Historically, coming out of wars and pandemics, we crave freedom and liberation: We predict the acceleration of sexy looks through skin-showing, formfitting bodywear with unexpected cutouts, all in comfortable knits worn with casual pants or shorts. Wear-to-work is transformed to become work-from-anywhere: Elevated knitwear or luxe lounge coordinated sets offer new alternatives to the sweatsuits. Optimistic colorful jewelry and novelty printed handbags—easy and happy accessories! Joy through a casual lens.

Maybe the most important is the anticipation of all tomorrow’s parties and how we will celebrate the holidays. We are hearing from friends who want to buy gowns and flashy sequin tops, dreaming of Great Gatsby–style exuberant fêtes. The 1920s and early-century fashion are already starting to influence the key silhouettes into leaner and languid, seductive designs. So, after all, we might live through our Roaring Twenties, and that would be fabulous!

Marco Tonizzo, Buying and Merchandising Director, Yoox

Vogue: Which pieces were your customers particularly responding to in 2020?

Marco Tonizzo: A different lifestyle changed the customers’ habits and their use of fashion, but they kept the joy of shopping. They redirected their spending to styles that catered to their new routine. We saw a surge of leisurewear/casualwear, but also accessories kept their share. Even with all the limitations of this new way of living, you can still love and buy a new bag or new shoes and share this joy with your friends through Instagram.

Which designers/brands/labels performed well for you?

Iconic designers and the designers that had a strong proposition before the pandemic remained relevant through their strong storytelling and community engagement. I’m thinking about Gucci, Saint Laurent but also Nike and Stone Island, to name a few.

Which newer names took off for you?

Among the big names that I mentioned and that are still the top sellers, we see smaller brands that are becoming more relevant recently, like Jacquemus and GCDS. Though they are absolutely different in terms of style and audience, they have in common the ability to connect very strongly with customers: For customers, buying something from them feels like being part of a community.

What, for you, was the biggest shift in fashion in 2020, in terms of what connected?

There is overall more consideration in buying. Before the pandemic, the approach to fashion was about excess. There was the urge for buying more and more and to show it off. The pandemic shifted this approach to a more conscious one. People still love fashion and buy fashion, yet they value more the styles that are long-lasting, timeless. The side effect is also reconsidering if and how their purchases impact the planet, and they appreciate it when a store or a brand offers something more sustainable.

What did you find didn’t connect this year?

Unfortunately, the circumstances forced all of us to skip events and, with them, the chance to dress up. All brands and items that once were big sellers for occasions have seen a great drop.

Charles Gorra, Founder and CEO, Rebag

Vogue: Which pieces were your customers particularly responding to in 2020?

Charles Gorra: We get a lot of data on the trends that we saw, what has and hasn’t sold, using an algorithm that lets us know instantly what people are buying. This year, there were some constants and a few novelties. Handbag resale is powered by the likes of Hermès and Louis Vuitton. We saw that all of their classic models have sold really well. That’s very much the impact of COVID; when the economy becomes more challenging, the consumer becomes more focused and investment conscious.

Which designers/brands/labels performed well for you?

With Bottega Veneta, we have seen an incredible interest in the resale side of things; some of the new Bottega bags sell close to their original retail price—80 or 90% of what they sold for. That tells you the level of interest. Daniel Lee has done an incredible job with things like the Pouch and the Jodie; they pretty much sell through instantly. And Dior has had a strong year; they’ve benefited from their vintage revival. The reissued Saddle bag has been a huge winner—and has increased the demand for the older vintage bags.

What, for you, was the biggest shift in fashion in 2020, in terms of what connected?

One interesting data point is that things sold. I would like to stress that. As a category, handbags and accessories have been quite shielded. If you look at apparel, that’s been difficult for many companies. We don’t have as many events, as many dinners. We have seen that accessories—not just bags but watches and jewelry—are quite steady. That’s a behavior we’re trying to develop: shifting from consumption to investment. There’s always going to be emotion in buying. It used to be all emotional, and now the spectrum is moving to that data point [of investing], and that’s what’s driving a purchase.

What did you find didn’t connect this year?

There have been some shifts. Those ultra-premium items, the deep five-digit items, the limited editions or exotics—those were all harder, a little bit slower and a little more conservative there [in the customer buying those]. Also, any item let’s describe as edgy or super frivolous, the thing you would have used for one night at a cocktail party. That philosophy of extraordinary items you’d use once or twice, that has slowed down a bit. And anything in between in size was less desirable: Mini bags sold well, everything that was micro, as did the opposite end of the spectrum, the oversized.

What’s your prediction for 2021?

The expansion of the resale mindset, particularly for bags but maybe across every category. COVID has fast-forwarded us two or three years in our behavior. Once the mindset shifts, I don’t see it going back. We will be thinking about the resale value but also sustainability; there’s going to be the emergence of a conscious consumer. Value-driven elements will meet societal or sustainability goals; we will join both together.

Tracy Margolies, Chief Merchant, Saks Fifth Avenue

Vogue: Which pieces were your customers particularly responding to in 2020?

Tracy Margolies: I’d say our customers are leaning into a more comfortable but put-together look. It’s neutral colors, head-to-toe knit dressings, pieces that were casual with comfort—but also fashionable. That’s really important to add. We’ve seen a rise in emotional investment pieces, from Bottega Veneta, Saint Laurent, Chanel, Balenciaga, Gucci, and Dior. Some of those sales are with classic bags, but we also saw the mini bag take off. There’s been an interest in activewear, particularly if it’s logo’d. And with shoes, it’s been sneakers, slides, and combat boots.

Which designers/brands/labels performed well for you?

[As well as the names already mentioned,] Moncler, Versace, Fendi, The Row, Balmain, and Burberry.

Which newer names took off for you?

One of the brands that we’ve recently brought in is Lou Lou Studio. The pieces are relaxed but with a more elevated silhouette. We also had a lot of success with Simon Miller.

What, for you, was the biggest shift in fashion in 2020, in terms of what connected?

The emphasis on casual dressing: less dresses, less tailoring but more sneakers. (Though high heels with emotion did well: Christian Louboutin, Amina Muaddi.) We’ve seen a big response to chunky chain jewelry from Boucheron and Bulgari. People are on Zoom, so they’ve been asking for pieces that are bold.

What did you find didn’t connect this year?

The whole special-occasion, black-tie, evening, very-specific dressing, for obvious reasons.

What’s your prediction for 2021?

I can’t wait for 2021. We are so excited about it already. What we all hope for is that we are going to want to celebrate and have lots of moments to get dressed up again. I also think we are going to want to travel again, so we will need things to travel in or to wear at resorts. And more bright colors: It’s time for happy clothes, happier times.

Kate Davidson Hudson, Founder, Editorialist YX

Vogue: Which pieces were your customers particularly responding to in 2020?

Kate Davidson Hudson: I’ve seen a definite return to investment pieces and pieces with a sense of familiar iconography. It feels as if consumer behavior on the luxury end of the spectrum is somewhat of a psychological reaction to the pandemic in that as everything around us is changing so rapidly and with such rampant unpredictably, shoppers default to the most familiar options.

As a result, the heritage and legacy brands, along with pieces rendered in classic silhouettes or treatments, connected with the most resonance this year. Legacy brands such as Chanel, Hermès, and Dior, along with classic pieces including diamond studs, tennis necklaces, and simple gold chains, were the most popular jewelry investments. Consumers seemed to disproportionately favor familiar designer name brands across all categories.

I also saw a heavy conversion rate across all categories of elevated athletic and leisurewear, for obvious reasons, as life in lockdown in many of our major markets created a new construct for how people were living their day-to-day lives. Designer derivations on classic sweatsuit options from The Row and Isabel Marant to eco-conscious lines like The Pangaia were important players this year.

In tandem, a return to the flat utility boot, Bottega Veneta and Chanel being among the top performers. Designer or legacy brand name sneakers also represent a larger share of closet space than in years past. And pure-play athletic wear, as many clients endeavored to stay in shape through home setups throughout the shutdown, also tracked with increased frequency.

Which designers/brands/labels performed well for you?

The tried-and-true legacy brands connected with the most resonance, Chanel, Hermès, Prada, Dior, Louis Vuitton, Saint Laurent, Cartier, Tiffany, and Van Cleef & Arpels, for example, were among some of the strongest performers. I also saw an increase in beauty spend (more specifically: skin care) as it’s likely that more of our consumers’ share of wallet recalibrated during the pandemic from experiential expenditures to self-improvement efforts (fitness, skin care, etc.) as a parallel focus to investing in the heritage fashion and jewelry brands.

Which newer names took off for you?

Sustainability and, more broadly speaking, brands who build community around larger ethically conscious ideals tracked with more import this year: The Pangaia, Reformation, Prada Re-Nylon, Veja, and AllBirds, as well as clean, ethically sourced beauty, were a larger part of the consumption picture.

Beyond socially-conscious-driven purchases, the newer labels that found relevance were those that referred back to or rooted their ethos in a derivation of more classic aesthetic archetypes, like a Khaite or Wardrobe.NYC. Think: the perfect trench, impeccably constructed knits, or a classic puffer jacket.

What, in your view, was the big shift in fashion in 2020?

I think 2020 forced the industry (and us as a company) to prioritize efficiency and smarter operating models, meaning a shift in collection production that is more demand driven and fashion shows with closer alignment to real-time customer consumption patterns, as well as a new reliance on digital innovations that are personalized to each customer.

With our YX app, once the pandemic hit, our private styling and operations team had to reengineer methods by which private styling clients could upload their digital closets onto the app without our production team being able to physically enter and inventory clients’ respective closets. The compounded need for digital born out of this year will represent a permanent shift in how consumers and retailers interact.

The one-to-one personalized correspondence through digital touch points, that also provide differentiated experiences, is what 2020 taught us will be the working formula for the industry in the future.

What did you find didn’t connect this year?

Generally speaking, a maximalist mood did not connect. Novelty statement pieces that felt charged with a sense of of-the-moment relevance or demonstrably trend driven were not among the pieces that connected this year. I think this makes sense given the inability for people to socialize and largely being confined to one’s home, the louder pieces felt incongruous with the overall mindset of clients.

Set against the current backdrop of financial uncertainty, I think even the top-level luxury clients with large pockets of discretionary income are seeking somewhat of a long-term value proposition in the pieces they are buying. This thinking naturally lends itself to the brands and aesthetics I’m seeing convert this year.

What’s your prediction for 2021?

I think as the fashion world and world at large struggles a bit to find its footing and sense of equilibrium, as the vaccine is disseminated and we emerge from this pandemic, the investment pieces, legacy brands, brands with a strong socially driven community, and luxe leisurewear options will continue to dominate. Digital is the biggest opportunity for 2021. People will likely continue to be hesitant to go into stores through much of 2021, so I think social commerce and any funnels through which brands can connect directly with the consumer, in a highly-personalized way to replace the in-store one-to-one correspondence of yesterday, are the next frontier.

We’re seeing this all day, every day, with the YX App. Consumers are now conditioned to transact online, and we’re seeing the adoption of digital styling and shopping skyrocket following the initial shock of the pandemic. It’s the multichannel methodology that is working: live chats, image or video sharing, high-touch customer service, and social commerce. This omni-channel approach will all contribute to increased digital penetration on the consumer end. Shoppers are savvier now: They will be looking for sophisticated digital experiences that connect with them personally and provide them a curated experience that replaces the emotional lure they once sought in brick-and-mortar stores.

In the future, I believe brick-and-mortar stores will take on more of a showroom role, whereas the bulk of transactions will take place digitally. For that reason, retail needs to find a way to dovetail into a consumer’s daily life at every touch point, not the reverse. For that reason, I think 2021 will see a seismic shift in the relationship between consumer and retailer, and those who can layer a human touch onto an intuitive digital experience will win.

Editor

Mark HolgateCredit

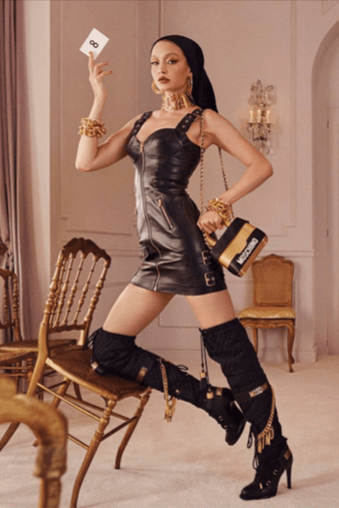

Lead image: Alessandro Lucioni / Gorunway.com