An undeniable side effect of the pandemic is how it’s caused people to reevaluate how they consume and spend. Recently, money has primarily been spent on essentials and otherwise saved because of the uncertainty the crisis has brought. A pandemic is likened to a war, not only due to the loss of lives but also because of how it plunges the global economy into recession. People who have disposable income to spend are choosing to take a more conservative route. Timeless pieces and classic styles are chosen over trendy ones, and pieces with lasting investment value are preferred. Here are five investment-worthy fashion-related purchases that have managed to retain their value through time.

Gold

Gold offers high liquidity even during challenging times because of its distinct position within the world’s financial and political ecosystem. It is after all one of the oldest tradable currencies in the world. Apart from the aesthetic value gold jewellery brings, investing in it can also offer profitable opportunities. Gold prices have increased by almost 500% in the last 20 years, is currently trading at a high and has recently crossed the $1,900 per ounce threshold. While 24k, pure gold jewellery is not the most suitable for regular use due to its softness and pliability, 18k gold (75% gold content, 25% combination of other metals) pieces are less expensive, can handle daily wear, and make just-as-good investments as well. A classic yellow gold chain necklace for layering or a chunky gold bracelet are both timeless pieces worth owning. And because gold is actively traded in world markets, the upside of your purchase is this: you can “cash- out” immediately should you decide to sell.

Diamonds

Loose diamonds certified under GIA (Gemological Institute of America) are compact and hold good value over time. Though the market is not as straightforward as gold and other commodities, many consider investing in diamonds over 1 carat in weight as sound. Fair warning though, turning your diamond investment into cash is not always instant and can cost you a considerable amount of time before it sells for the price you hope to get that’s within current market value. Four factors to consider before buying diamonds are: carat, colour, clarity, and cut. The weight of a diamond is measured in carats. But just because a diamond has a heavy carat weight does not automatically make it more valuable or expensive. Diamonds are also colour-graded from D to Z – from colourless or white, to yellow. The whiter and less tint the diamond has, the more value it brings. It is important to note that Z-coloured diamonds are not the same as fancy yellow diamonds, and the grading system for coloured stones are different. Clarity determines the inner stone quality of diamonds. A diamond devoid of blemishes and inclusions is graded FL for flawless. There are more than 10 grading scales (FL-I3) for clarity – I3 or “included” being the most flawed. A diamond’s cut also plays an important factor in price. Historically, round diamonds are most popular and considered the most expensive cut and shape due to the cutting wastage – a large portion of the rough stone is discarded during the cut-and-polish process. Demand in a particular cut also affects the price of the diamond. In the end, buy a diamond not just for the sole purpose of investing, but also because you actually like it and will wear it too. A diamond ring or pair of diamond earrings are good, classic pieces to own.

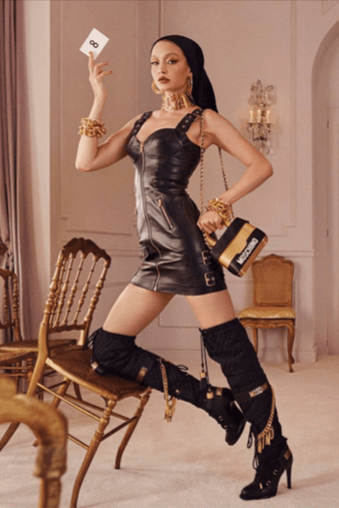

Designer Bags

Hermes and Chanel bags have steadily maintained their value over time due to their yearly price increase, high consumer demand, and, specifically for Hermes, their limited availability. When it comes to their resale value, vintage (over 7 years old) Hermes bags like the Birkin and Kelly, as well as Chanel Classic Flap bags, as long as they’re in excellent condition, easily retain their original purchase value if they had been bought at retail price years ago. Today, these brands are high on the list of many bag lovers not just for desirability but also for their investment value. Brand new Hermes Birkin and Kelly bags in smaller sizes do particularly well and have an average resale value of not lower than 85% above their retail price. A report from Business Insider stated that a Hermes Himalayan Alligator Birkin was resold in 2019 to a professional sports betting consultant for a record price of over half a million dollars (at least 200% above retail). Hermes Birkin prices have increased by 500% in the last 35 years, while Chanel Classic Flap bags have increased by at least 400% in the last two decades. Prices continue to climb each year, economic crisis or not. If you have one of these bags, taking proper care of it during use will get you a fair return should you decide to sell it later.

Watches

Unlike decades earlier, large-faced wristwatches have become more popular and also “genderless.” And like designer bags, fine watches have become a symbol of wealth and social status. According to a New York Times story by Alex Williams, “in the event of an economic downturn, fine watches may turn out to represent a safe-haven asset, like metals or gems, for investors looking to diversify their portfolios.” Jorg Weppelink of Chronos 24 noted that three of the most coveted watches today are by Rolex, Patek Philippe, and Audemars Piguet. And while not all models from these brands will double or triple in value over time, some specific models that are in demand undoubtedly will. Styles like the Rolex Daytona and the Submariner, Patek Philippe Nautilus, and Audemars Piguet Royal Oak are pieces with investment longevity due to limited production and high consumer demand. Vintage or antique fine watches with complications or important provenance do extremely well too. A unique example is the 1968 Rolex Daytona Paul Newman, owned by Paul Newman himself. That watch, which probably cost about $200 at the time, sold at auction in 2017 for an astounding $17.75M! Investing in a fine wristwatch with a mechanical (manual-wind) or automatic (self-winding) movement over a quartz (battery-operated) one is always preferred.

Signed Jewellery

Jewellery from the Alhambra collection of Van Cleef and Arpels, and the Love and Juste un Clou collection from Cartier lead the charge when it comes to signed commercial jewellery that retain a majority of their retail value. But bespoke, exclusive pieces from a rarefied few contemporary jewellers have a stronger investment value. Most pieces produced by these designers are not just considered jewellery but are in themselves works of art. Hemmerle falls into this category. This fourth generation, family-run jewellery maison based in Munich makes only a limited number of bespoke pieces which take months and even years to complete. Their artisans meticulously handcraft each piece using centuries-old traditional methods with today’s available technology. What continues to set them apart is their unique ability to utilise unconventional raw materials, from wood and antique tchotchkes to industrial alloys, and turn them into miniature pieces of wearable art that take inspiration from nature, architecture, and the arts. Another important contemporary jeweller is Joel Arthur Rosenthal, also known as JAR, who began his career not as a jeweller but as a screenwriter. He was self-taught, and moved to Paris from New York in 1977 when he set up a nondescript salon (he has only one small jewellery vitrine outside, and it’s always empty) by Place Vendôme. Well known for setting gems in blackened metals with fine pavé and degrade-style arrangements, JAR only produces between 60 and 80 pieces of jewellery a year, making them coveted by high profile clients like actress Gwyneth Paltrow and Princess Marie Chantal of Greece. While a referral is needed to secure an appointment, JAR pieces occasionally feature in important auctions. The most prominent JAR sale happened in 2006 and came from the 16-piece lot of actress Ellen Barkin who unloaded them after her divorce from billionaire investor Ron Perelman – those 16 pieces netted over $7M in sales! The international auction circuit is a good place to start if you’re in search of works by contemporary jewellers.

A tip before investing

Ultimately, before you make any purchases involving large amounts, always do a thorough research on the merchandise you are planning to buy, and from whom or where you are buying it. Familiarising yourself not only with the product but also with current market movements will ensure that you have a better understanding of your investments. And above all, don’t forget to enjoy your investments too!

Editor

Ingrid Chua